*TeachersRetire is not affiliated with, endorsed or approved by PSERS*

Leading up to retirement, you will have several important decisions. You’ll be making choices about:

- Your pension option

- Whether to withdraw your contributions and interest

- Who to name as your beneficiary or survivor annuitant

- How much tax to withhold from your pension payments

- Likely a few more!

These decisions are impactful to your retirement financial picture as well as that of your spouse and family. However, no matter how much planning you do, your life and circumstances might change in retirement. You might need to make adjustments to adapt your financial life to your new situation. This may include needing to make changes to your PSERS pension.

Some of your pension information and choices are simple to adjust while others are permanent once your retirement application is processed. In this article, we’ll explore what about your pension you can change after retirement and which choices are irreversible.

Simple administrative pension changes

Some pension changes, like your pension option and beneficiary, are more complicated and come with stipulations. We’ll get to those in a little bit. The majority of changes most PSERS retirees will need to make are generally minor and administrative. These are changes like:

- How much tax you want withheld from your pension payments

- Change of address

- Direct deposit changes

- Beneficiary or survivor annuitant address change

Most of these changes can be made easily by filling out and submitting a form to PSERS. Some can be made right in your PSERS Member Portal. You can find the list of PSERS forms here.

Changes to your “BIG” retirement decisions

We consider your “BIG” retirement decisions to be your pension option, whether to withdraw your contributions and interest, and who you name as your beneficiary or survivor annuitant. These elections can each impact your monthly pension payment, retirement financial picture and, potentially, the financial lives of your family. PSERS allows you some flexibility to make adjustments to your pension in retirement but some choices are permanent. Let’s dive in.

Can I change my contributions and interest decision?

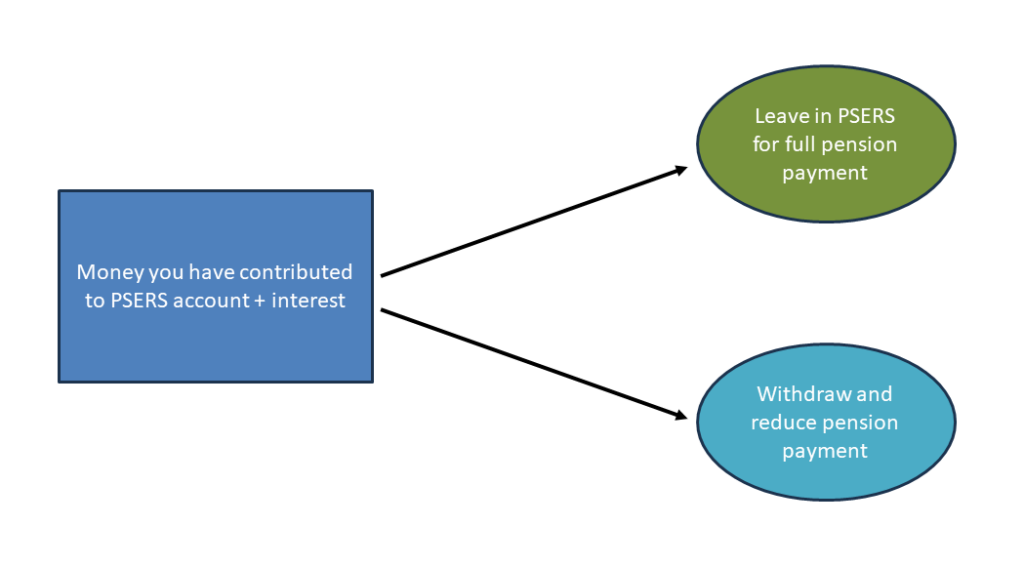

Before we go further, let’s make sure you understand the decision you have to make in regards to your contributions and interest.

Throughout your career, you have contributed to your PSERS account each paycheck. These contributions have grown by a fixed interest rate over time. At retirement, you can choose to leave that money in PSERS. In exchange, you will receive your full pension payment based on the pension option you select. If you withdraw your contributions and interest, your pension payment will be adjusted lower to reflect your withdraw.

Whether to withdraw your contributions and interest is an important and complicated decision. You can explore and learn more about this decision here. There could also be tax implications to withdrawing your money which you can learn about here.

Once you have chosen to withdraw or leave behind your contributions and interest in PSERS, the decision is irreversible. PSERS will calculate and process your monthly benefit based on this decision and it can’t be changed at any point.

Can I change my pension option in retirement?

There are five PSERS pension options from which to choose. Each offers a different monthly payment amount depending on how much protection is offered to a spouse or other beneficiary. The more protection, the lower the monthly payment. We won’t dive into the specifics of each pension option in this article (you can do that here, here and here!). However, its important to understand a few aspects of these options so you know what is adjustable after retirement and what is not.

| Pension Option | Who Could Inherit Something? | What Could They Get? |

| Maximum Single Life Annuity | Beneficiary | Lump Sum Payout |

| Option 1 | Beneficiary | Lump Sum Payout |

| Option 2 | Survivor Annuitant | Continue Pension |

| Option 3 | Survivor Annuitant | Continue Pension |

| Option 4 | Survivor Annuitant | Continue Pension |

The Maximum Single Life Annuity (MSLA) and Option 1 offer the potential for your beneficiary to receive a lump sum payout at your death. How much they receive depends on whether you withdraw your contributions and interest and the Present Value of your pension. Who you name as your beneficiary (spouse, children, sibling, etc.) doesn’t change your pension payment or potential lump sum payout which means you can change your beneficiary at any time if you choose the MSLA or Option 1.

However, if you choose the MSLA or Option 1, you cannot change to a different pension option in retirement. That decision is irreversible.

Should you choose Option 2, 3 or 4, you could have flexibility to make more changes in retirement. Rather than a “beneficiary” these pension options have a “survivor annuitant”. This person will continue all or a portion of your pension payment for the rest of their life if you die first. They do not receive a lump sum payment.

Options 2-4 allow you to change your pension option and your survivor annuitant under two conditions:

- Your survivor annuitant dies before you

- You become divorced and your spouse is your survivor annuitant

Should either of these events happen, you can contact PSERS to explore making a change. It’s important to remember that changing your survivor annuitant will likely change your monthly payment. PSERS factors the age of your survivor into your payment calculation. For example, if you had your spouse named as survivor and change to your child, PSERS will likely lower your monthly payment.

Before making a change under Options 2-4, you can request that PSERS prepare an estimate of how the change will impact your payment. Learn more about PSERS’s procedures for changing these options and your survivor annuitant here.