*TeachersRetire is not affiliated with, endorsed or sponsored by PSERS*

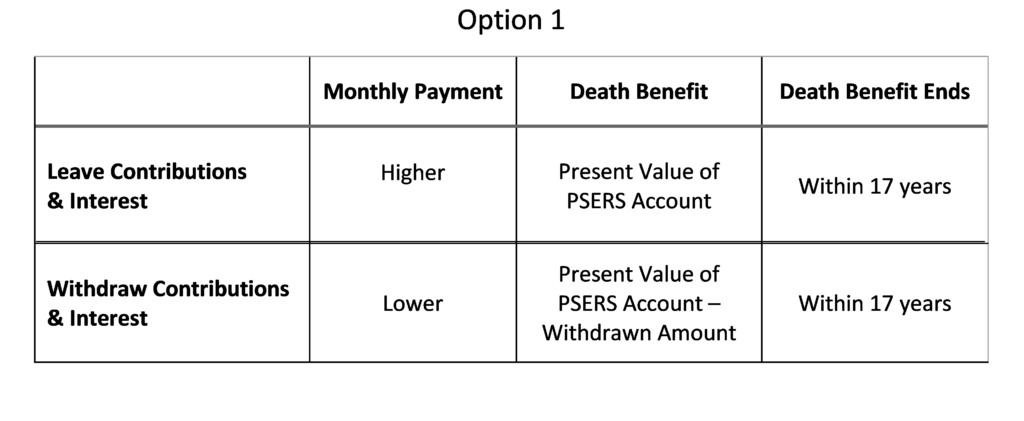

Option 1 gives you the second highest monthly payment of all the PSERS pension options. The payment is reduced in order to provide a much larger death benefit than the Maximum Single Life Annuity. People who want their spouse or other beneficiary to have a greater potential death benefit might find Option 1 to be a better fit.

What happens with Option 1 when I die?

When choosing Option 1, your PSERS account is given a Present Value at retirement. Essentially, The Present Value is a calculation of the value today of your pension payments over your life expectancy. Someone with many years of service could have a Present Value of $750,000 or more. You can find the current Present Value of your pension on Page 3 of your PSERS Statement of Account which you can access on the Member Self Service Portal.

If you die and you have not received pension payments equaling the Present Value of your PSERS account, your beneficiary will receive the difference in a lump sum payment. Generally, you must die within 17 years of retirement for your beneficiary to receive a death benefit from PSERS. If you die after that time, there is no death benefit or continuation of your pension for your beneficiary.

An example of how the death benefit works

Jeanne has retired and elected pension Option 1. Her monthly payment is $4,000 per month. Her PSERS account is given a Present Value of $816,000. So, her death benefit at retirement is also $816,000. Every month that Jeanne receives her payment, her death benefit is reduced by $4,000. If she dies after 5 years, her beneficiary would receive $576,000 in a lump sum.

$4,000/month x 60 months = $240,000 $816,000 – $240,000 = $576,000 death benefit

If Jeanne died after 17 years of retirement, her beneficiary would not receive any money from PSERS.

$4,000/month x 17 years = $816,000 $816,000 – $816,000 = $0 death benefit

When you apply for retirement with PSERS, you have the option of leaving your contributions and interest in your PSERS account or withdrawing some or all of that money. Your contributions and interest are factored into the Present Value calculation. If Jeanne decides to leave her money in her PSERS account, the death benefit would play out as described above. If she decided to withdraw all of her contributions and interest, the Present Value of her PSERS account would be lower as would her monthly pension payment.

Is pension Option 1 right for me?

Option 1 might be a good choice for someone who is married and wants to make sure that their spouse receives a relatively large lump sum death benefit if they die early in retirement. It could make sense if you will pay off a mortgage soon after you retire or have less of a need for a death benefit as you age into your 80s and 90s. Option 1 could also be a consideration if your spouse has their own pension. In this case, your spouse would still have dependable monthly income from their own pension and the loss of your monthly PSERS payments may be less of a financial strain.

This option is usually not a good choice for those who want their PSERS pension to provide guaranteed income for life to their spouse. As you now know, there is a good chance that you could outlive the death benefit period. According to the most recent Social Security Life Expectancy Table, a 60 year old male retiree has a life expectancy of 21 years. A 60 year old female retiree has a life expectancy of 24 years. this takes both retirees into their early-80s and beyond the death benefit period for Option 1.

If pension Option 1 doesn’t seem like a good fit for you, learn more about the Maximum Single Life Annuity and Options 2 and 3.