*TeachersRetire is not affiliated with, endorsed or sponsored by PSERS*

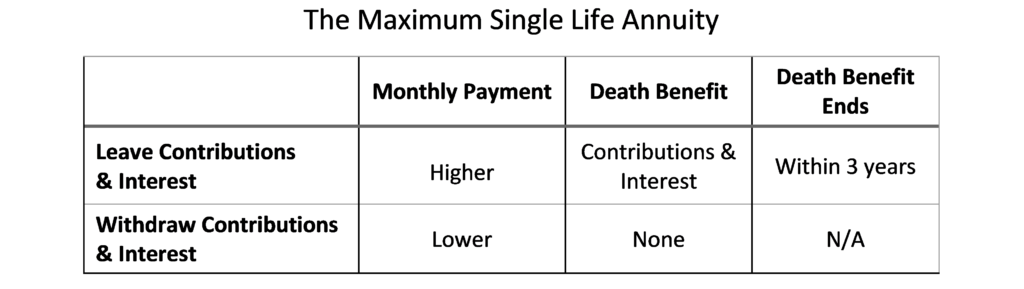

The Maximum Single Life annuity (MSLA) provides you the highest monthly payment of all the PSERS pension options. As you may guess, there is a tradeoff for that bigger monthly check. As with each pension option, the tradeoff for the amount of income you receive is what happens with your pension after you die. The more money you receive, there will be less for your beneficiary. Since the MSLA provides the most monthly income, it offers the least amount of death benefit.

What happens with the Maximum Single Life Annuity when I die?

Over the years, you contribute to your pension account from each paycheck. It’s likely you’re adding 6.5% or 7.5% of your salary to your account each year. This money accumulates in your PSERS account and grows at an interest rate of 4% in the first year and 3% each year thereafter. You can find the total of your contributions and accumulated interest on Page 2 of your PSERS Statement of Account or in your PSERS Member Self Service Portal.

When choosing the Maximum Single Life Annuity, your contributions and interest become your death benefit after retirement. If you die and you have not received pension payments equaling at least your contributions and interest, your beneficiary will receive the difference in a lump sum payment. Generally, you must die within the first 3 years of retirement for your beneficiary to receive a death benefit from PSERS.

An example of how the death benefit works

Mark has elected the Maximum Single Life Annuity. His monthly payment is $5,000 per month. His contributions and interest total $180,000. His death benefit at retirement is also $180,000. Every month that Mark receives his payment, his death benefit is reduced by $5,000. If he dies after two years, his beneficiary would receive $60,000 in a lump sum.

$5,000/month x 24 months = $120,000 $180,000 – $120,000 = $60,000 death benefit

If Mark passed away after three years of retirement, his beneficiary would not receive any money from PSERS.

$5,000/month x 24 months = $120,000 $180,000 – $120,000 = $60,000 death benefit

When you’re applying for retirement with PSERS, you have the option of leaving your contributions and interest in your PSERS account or withdrawing some or all of that money. If Mark decides to leave his money in his PSERS account, his death benefit would play out as described above. If he decided to withdraw all of his contributions and interest, there would be no death benefit for his beneficiary from Day 1 of retirement. The only way to provide the death benefit is to leave some or all your money in PSERS.

Is the Maximum Single Life Annuity right for me?

In general, this pension option might be a good choice for someone who is not married or who doesn’t have anyone relying on them financially. It may also make sense if your spouse has a sizeable pension benefit of their own or plenty of investments and other assets to live on after your death. Remember, you will only leave a death benefit behind if you leave your contributions and interest in PSERS and pass away within three years of retirement.

The Maximum Single Life Annuity will likely offer you several hundred dollars more per month for the rest of your life than the other pension options. However, this additional income comes with a major risk of leaving your spouse without an important source of dependable monthly income. If your PSERS pension is an important source of retirement income, one of the other pension options is likely a better choice than the Maximum Single Life Annuity. Learn more about Option 1 and Options 2 and 3.