*TeachersRetire is not affiliated with, endorsed or sponsored by PSERS*

The 2020-2021 school year is likely the most challenging for Pennsylvania educators in recent memory. It is no surprise that the difficulties of this school year have many teachers, administrators and school staff thinking about retirement. Those who were planning on retiring in the next few years may be wondering if they can stop working sooner rather than later.

If you are considering retirement earlier than originally planned, you should know how your PSERS pension will be impacted. You likely are aware that the more years you have of credited service, the higher your monthly benefit and vice versa. By retiring earlier, you will receive a lower monthly pension payment. The basics are fairly simple.

However, a more important factor in the amount of your pension payment is your status with PSERS at the time you decide to retire. Before making any final decisions about retiring early, you need to know your current retirement status and your status at the time you plan to stop working.

Normal Retirement vs. Early Retirement

There are two retirement statuses in PSERS: early and normal. Which you fall into will make a major difference in your monthly pension.

Those who have reached normal retirement status will receive their full monthly benefit based on the pension formula. Those who retire early will have a reduced monthly benefit. To qualify for normal retirement, you must have reached one of the following three milestones:

- Age 62+ at retirement

- Age 60 with at least 30 years of credited service

- 35+ years of credited service

If you have not reached one of these milestones, you are considered to be retiring early. If you are thinking about retiring earlier than originally planned, a few less years of credited service could change your status from normal to early. If that is the case, the big question is how much it impacts your pension.

How Much Does Retiring Early Lower My Pension?

Let’s look at an example of how qualifying for normal retirement rather than early can lead to a higher monthly retirement income.

Mary is a 56-year-old teacher. She has been teaching for 28 years in PSERS and is strongly considering retiring at the end of this school year. Since she has not reached any of the milestones for normal retirement, Mary would have a reduced monthly payment if she stopped working now. She is wondering if working a few more years for a higher pension payment would be worth it.

Here are Mary’s hypothetical monthly pension payments:

| Timing | Age | Years of Service | Status | Monthly Pension |

| Now | 56 | 28 | Early | $3,500 |

| Wait two years | 58 | 30 | Early | $4,000 |

| Wait four years | 60 | 32 | Normal | $4,800 |

You can see how a few extra years of work can increase Mary’s pension, even if she is considered retiring early. However, the pension payment is increased even more when she works until age 60 and qualifies for normal retirement.

It is important to keep your retirement status in mind as you explore your retirement options. If you are close to qualifying for normal retirement, you should consider how reaching that milestone will impact your payment and financial picture. Is working a few more years worth the higher pension payment for the rest of your life?

Before making these decisions, you have to know your retirement status with PSERS.

Four easy steps to find your PSERS retirement status

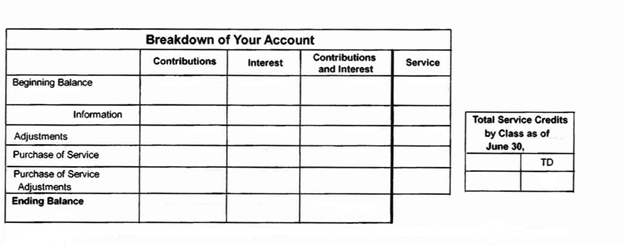

1. Check your most recent PSERS Statement of Account

Turn to Page 2 of your most recent statement and find the small grid in the top-right side that reads, “Total Service Credits by Class…” Here, you can see how many credited years of service you have earned as of last June.

If you don’t have the paper copy of your PSERS statement, you can access it online by using the Member Self-Service Portal.

2. Add a year of credited service for each year that you plan to work.

3. Write down the age you will be when you stop working.

4. Answer these three questions:

- At your selected retirement date, will you be at least 62 years old?

- At your selected retirement date, will you be at least 60 with 30+ years of credited service?

- At your selected retirement date, will you have 35+ years of credited service?

If you answered “Yes” to one of these questions, you will have reached normal retirement status with PSERS.

What should I do if I’m seriously considering retiring early?

It’s okay to retire before reaching normal retirement. Many educators do so, regardless of the financial implications. Sometimes, deciding to retire goes beyond the dollars and cents. However, knowing your retirement status is only half of the equation. If you want to feel like you are making the best decision for yourself and your family, you have to consider the impact on your entire financial picture before you make any final decisions.